There are several ways to invest money in UAE. Saving cash stays the first concern among numerous inhabitants in the UAE, yet shockingly, a couple can save an enormous piece of their pay to get a familiar retirement or satisfy their monetary objectives throughout everyday life. Let’s see about the 5 best ways to invest money in UAE.

As indicated by a study by Payfort, an Amazon organization, most the individuals living in the UAE (38%) can save just 10% of their pay, while just not exactly a quarter (23 percent) figure out how to pass on 10 to 25 percent of their income immaculate. A stressing 28 percent, almost three out of ten individuals, are not saving by any means.

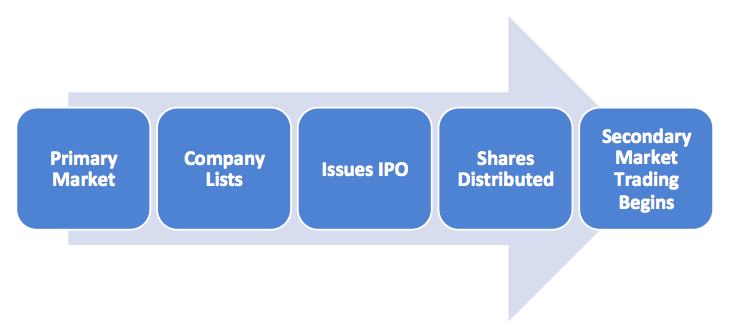

1.Put resources into stocks

Stocks are perhaps the most famous speculation option for the people who don’t have a place with the high-total assets fragment. They are very reasonable and you can purchase shares from a portion of your cherished organizations for under Dh100.

Note, in any case, that when purchasing stocks, one should enroll the administrations of a markdown representative rather than a full-administration proficient, which just works with financial backers who have a huge load of cash to contribute or the people who can stand to pay a high least store and commission.

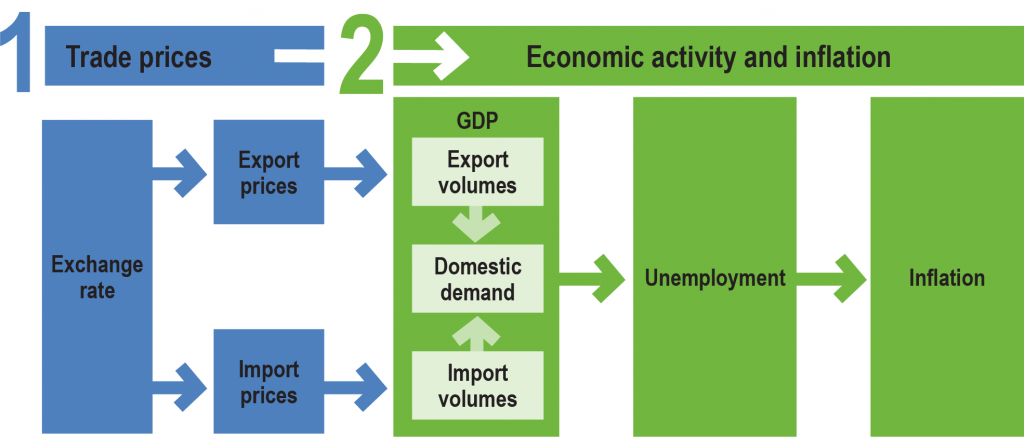

2. How about trade exchanged assets?

Like stocks, trade exchanged assets (ETFs) can be bought at low expenses through a specialist, and the financial backer can contribute however many offers as they like. Since the expansion is vital when contributing, regardless of how little or huge the seed cash is, it is ideal to save a piece of your Dh2,000 for certain ETFs.

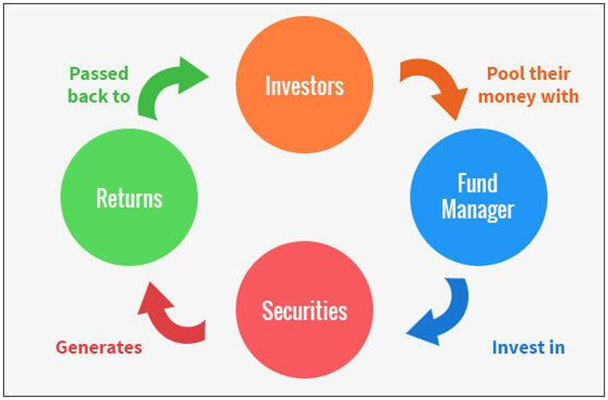

3. The most common: Mutual funds

By picking this choice, you can profit from the skill of an asset administrator, who will do the school work for you –, for example, choosing the best protections, or stocks and securities that could bring in your cash development. The beneficial thing is, you needn’t bother with countless dirhams to begin purchasing shares.

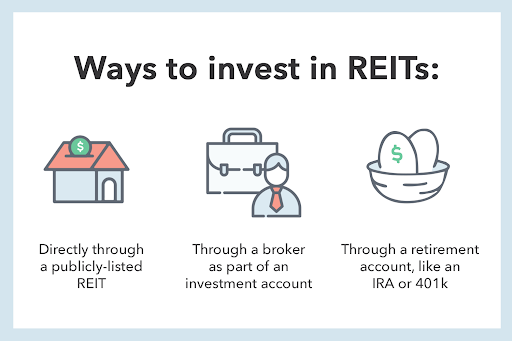

4. REITs (Real estate investment trust)

REITs are extraordinary for those searching for how to invest money in UAE and need to acquire openness to land without the dangers of claiming a property. These are loads of organizations that buy land properties (Equity REITs) or give contract offices to land financial backers (Mortgage REITs).

In a PWC report, the UAE had the fourth-most noteworthy yearly profit yield on REITs worldwide, obscuring heavyweights like the US, UK, Germany, Australia, and Singapore.

5. Gold will be the best to invest money in UAE

“Gold is likewise a generally held resource in very much expanded portfolios as it tends to be utilized to fence against expansion. I would say that a 5 percent holding in gold gives relative security, just as adding to the enhancement of a portfolio,” said Phillips.

Yet, in light of the fact that you’ve as of now stopped your Dh2,000 in the proposed speculation choices, doesn’t mean you would now be able to plunk down and trust that your cash will develop.

Five ways to invest money in UAE: facts to consider

Be attentive when putting resources into bonds

You should think about placing a part of your Dh2,000 in bonds. While it seems like a good thought, particularly since there are a couple of bond choices that don’t need immense speculation, some monetary organizers prompted it is ideal to practice some alert.

Avoid forex, fates

Phillips concurred, saying that such ventures require expert aptitude and the dangers implied are not helpful for the people who need to put something aside for retirement.

Phillips concurred, saying that such speculations require expert mastery and the dangers implied are not favorable for the people who need to put something aside for retirement.

Outsomes

To invest money in UAE, you need to:

- Make a growth strategy that incorporates your present circumstance, objectives, financial plan, venture choices, and a backup stash

- Find out with regards to how to apply long haul contributing

- Plan to put resources into an expanded arrangement of ETFs and REITs

- Pick a portfolio with a decent return-hazard balance that coordinates with your own objectives and advantages from low expenses

![The Top & Most Popular Seafood Bucket Restaurants in Dubai for you [Never Miss]](https://uae24x7.com/wp-content/uploads/2020/09/8-seafood-in-a-bucket-scaled-e1600739237403.jpg)

![Procedures for Renewing the Driving License in Abu Dhabi [3 Simple Steps]](https://uae24x7.com/wp-content/uploads/2020/07/Capture-9-e1595666454466.jpg)